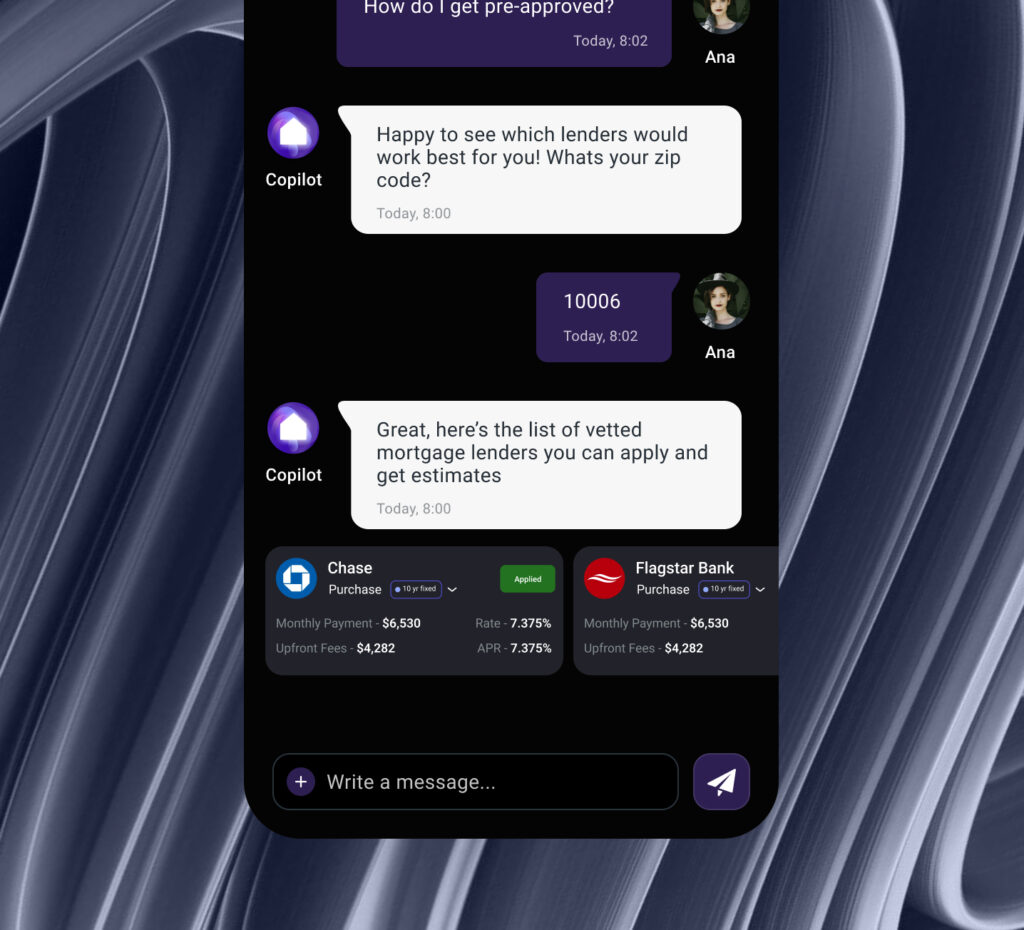

Simplifying the mortgage journey for homebuyers and lenders through intelligent automation and personalized guidance.

Dwella is a mortgage automation platform designed to modernize the mortgage experience by reducing manual effort, simplifying complex processes, and connecting homebuyers with the right lenders. The platform leverages AI and large language models (LLMs) to guide users from discovery to pre-approval, creating a smoother experience for buyers while delivering better-qualified leads to mortgage professionals.

Weeks to launch from client brief

to MVP

The mortgage process is notoriously fragmented, opaque, and time-consuming—particularly for first-time buyers. Lenders struggle with lead quality, document management, and client communication, while homebuyers face overwhelming decisions and a lack of transparency. Dwella aimed to solve both sides of this equation with an AI-first platform that automates workflows and delivers personalized support at scale.

We built Dwella from the ground up, designing an intelligent workflow that automates loan discovery, borrower education, document collection, and lender-matching. Using custom-trained LLMs and real-time data integrations, the platform provides users with contextual guidance and next steps—while streamlining operations on the lender side with automated communication and qualification logic.

Dwella is currently in its pilot phase with lenders and select homebuyers. Early results show significant reduction in manual tasks, improved borrower experience, and increased conversion rates for participating mortgage partners. The platform has helped both sides of the transaction gain clarity, save time, and make better decisions through AI-powered personalization and automation.

AI-powered internal analytics platform for enhanced decision-making

Empowering developers to integrate AI into real-world software development workflows.

Customizing a domain-specific LLM to power intelligent search and knowledge discovery across scientific datasets.

AI-powered computer vision system to support non-invasive, early diagnosis of feeding challenges in newborns.

Modernizing data infrastructure and enabling intelligent decision-making for one of the world’s leading investment firms.

Empowering employees to document experiences, understand rights, and navigate workplace challenges with confidence.

Simplifying the mortgage journey for homebuyers and lenders through intelligent automation and personalized guidance.

Helping organizations improve employee health through personalized coaching, smart goal tracking, and AI-powered feedback.

RadCard set out to create a gamified loyalty and discovery platform that helps users discover local businesses, events, and promotions while earning rewards…

Facilitating spontaneous connections through intelligent activity recommendations and user matching.

Empowering individuals worldwide to engage in fitness challenges, track progress, and achieve their health goals through a competitive and supportive community.

Revolutionizing dance education through personalized class recommendations and enhanced social engagement.

Connecting individuals with personalized local experiences through intelligent recommendations and community engagement.

Launched a full-stack IoT solution that helped Atomi break into the smart home market and secure major retail partnerships.

.

WaBu (short for “Walking Buddy”) is a mobile app designed to connect university students and older adults for walk-based social wellness.

Merging fan commentary and real-time engagement into a community-driven sports debate experience.

Empowering businesses with a unified, modular security solution to combat evolving cyber threats.

Empowering employees to document experiences, understand rights, and navigate workplace challenges with confidence.